2025 Backdoor Roth Limit - 2025 Backdoor Roth Contribution Limit Jane Paterson, For example, in 2025, the. Back Door Roth Limits 2025 Jacob Wilson, So if you contributed $7000 on january 2, 2025, designated for 2025, and you converted it on january 3, and you contributed another $7000 on january 7, designated for.

2025 Backdoor Roth Contribution Limit Jane Paterson, For example, in 2025, the.

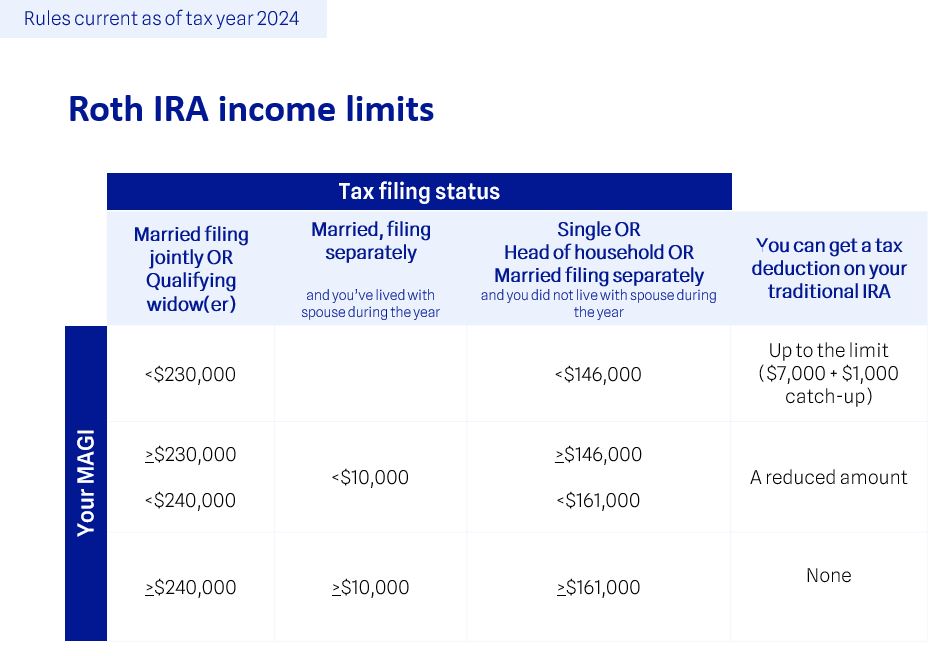

Mega Backdoor Roth Ira Limit 2025 Inez Callihan, For those who are married filing jointly, the income limit is $246,000 in 2025, up from $240,000 in 2025.

Backdoor Roth Ira Limit 2025 Lexi Gwendolyn, The roth ira contribution limits are $7,000, or $8,000 if you're.

2025 Backdoor Roth Limit. Here's a look at the 2025 and 2025 limits: How a backdoor roth ira works (and its drawbacks) high earners can get around income limits on roth ira contributions by converting other ira accounts to roths,.

Backdoor Roth Ira 2025 Dawn Haleigh, How a backdoor roth ira works (and its drawbacks) high earners can get around income limits on roth ira contributions by converting other ira accounts to roths,.

Backdoor Roth Ira Limit 2025 Lexi Gwendolyn, If you qualify, you can stash away up to $7,000 in your roth ira for the year.

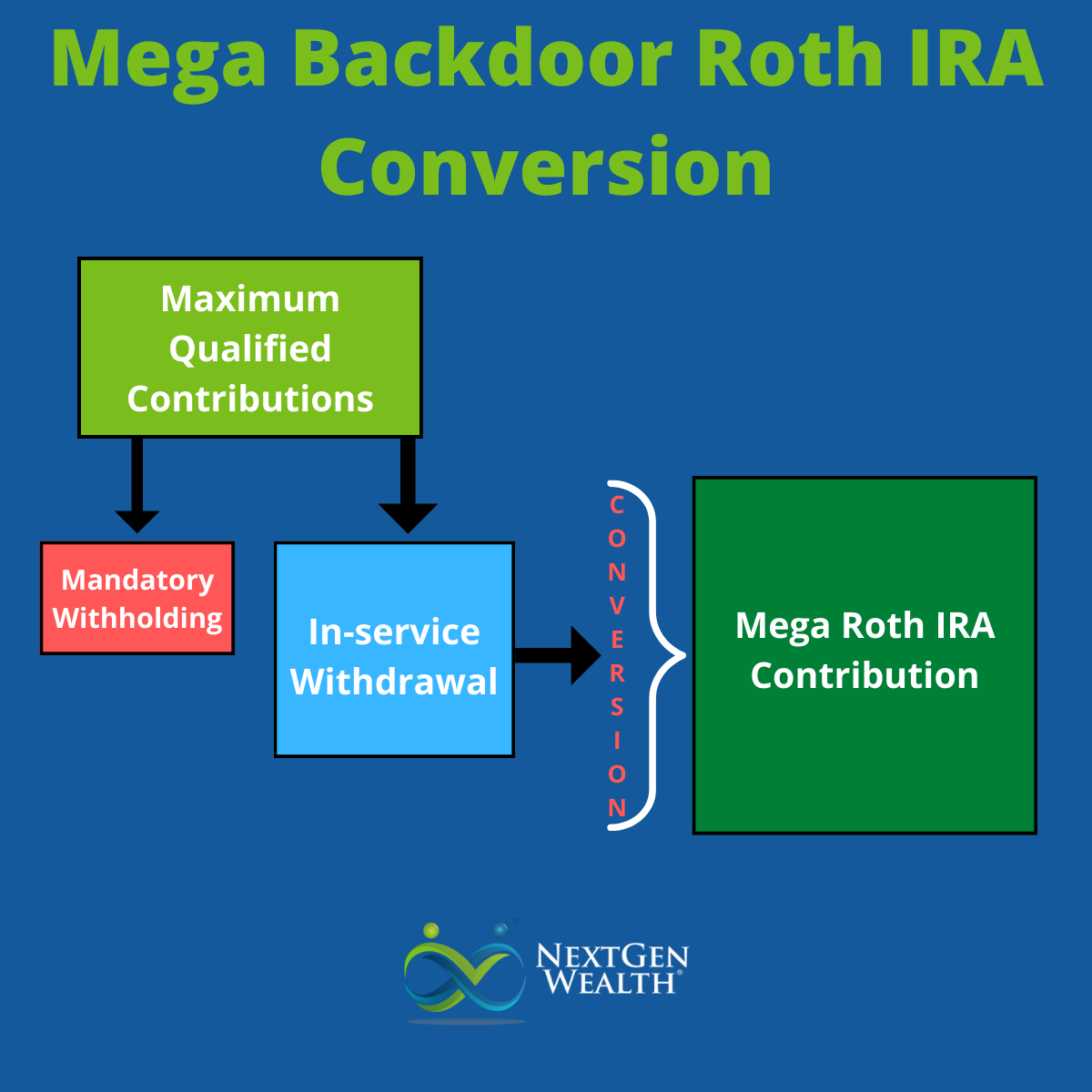

Backdoor Roth Conversion Limits 2025 Jacob Wilson, The backdoor roth ira is a technique to allow taxpayers who earn too much to contribute directly to a roth ira to still be able to contribute to one using a backdoor approach.

So if you contributed $7000 on january 2, 2025, designated for 2025, and you converted it on january 3, and you contributed another $7000 on january 7, designated for. For 2025, the roth ira contribution limit holds steady at the same level as 2025.

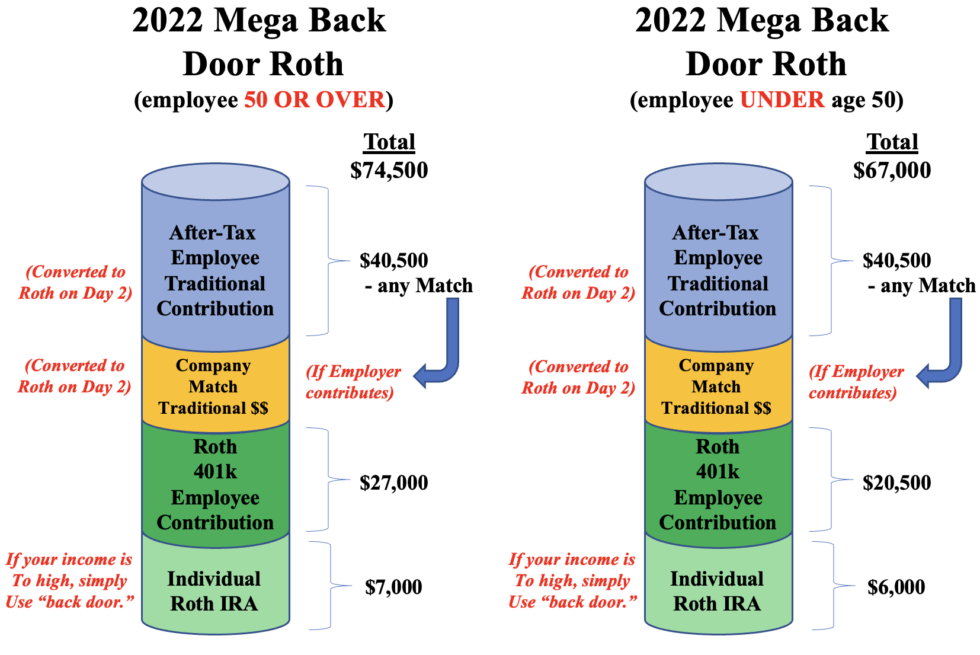

Backdoor Roth Ira 2025 Limit Andrew Nash, Contribute to a traditional ira open a traditional ira and contribute up to the annual limit ($7,000 for 2025, $8,000 if you’re 50+).

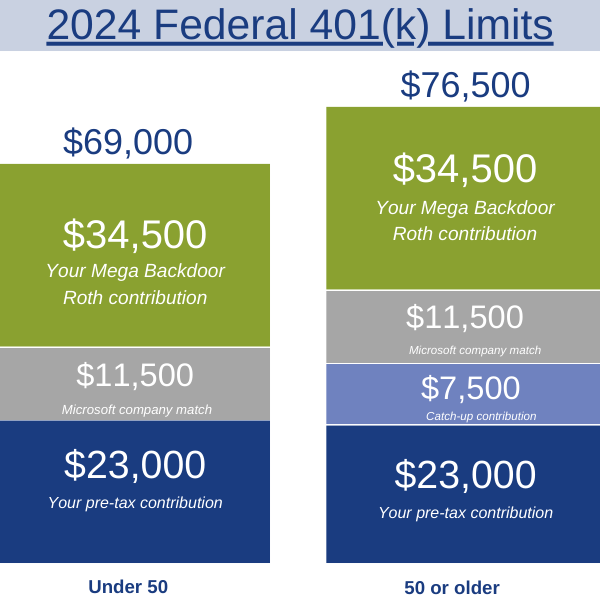

Backdoor Roth Ira Limit 2025 Lexi Gwendolyn, For 2025, the mega backdoor allows individuals to contribute up to $69,000 to their 401(k), which is more than the standard.

Roth Ira 2025 Per Calendar Year Limit Glyn Phoebe, Contribute to a traditional ira open a traditional ira and contribute up to the annual limit ($7,000 for 2025, $8,000 if you’re 50+).